At the end of September 2024, the number of employees in the Swiss watch industry was still very slightly up on the same period the previous year, supported by the growth recorded at the end of 2023 and the sector’s resilience in the face of a complex economic environment. Nonetheless, persistent uncertainties point to a more difficult 2025.

For the second year running, the number of employees in the sector will remain above the 65,000 mark, with an increase of 405 positions (+0.6%) compared to 2023. Published by the Swiss Watch Industry Employers’ Association (CP) as part of its annual census, these figures testify to the robustness and attractiveness of an industry that continues to face economic and geopolitical uncertainties.

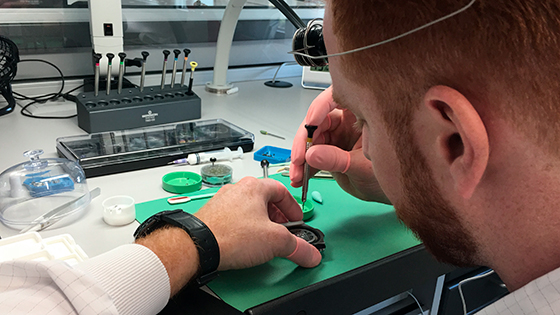

The number of production-related employees confirmed their central role in the watchmaking value chain, reaching 46,493 (+1.1%). This increase illustrates the strategic importance of production activities in a sector focused on quality and excellence. On the other hand, administrative staff numbers saw a slight decrease of 0.8% (-145 positions), marking a stabilisation of needs in this area after a sharp rise in 2023.

The watch industry is continuing to upgrade its skills, a key factor in its competitiveness. The number of employees with higher education rose by 2.7% (+435 people), while employees with a vocational diploma increased by 1.1% (+315).

These figures confirm the sector’s commitment to ongoing training and skills development, in response to the rapid evolution in technologies and the high demands placed on the industry.

The Arc horloger remains the heart of the watch and microtechnology industry, accounting for 93.4% of the total workforce. Neuchâtel, Berne and Geneva dominate, with 17,511, 14,239 and 12,288 employees respectively, representing more than half of total employee numbers.

There was a notable increase in the canton of Fribourg (+12.8%), while there was a proportional decrease in the canton of Ticino (-13.2%). Other cantons, such as Solothurn and Jura, recorded more moderate variations, confirming the overall stability of the geographical spread of the workforce.

While 2024 ends with relatively stable employee numbers, the outlook for 2025 is much more uncertain. Persistent economic turbulence, geopolitical tensions and the strength of the Swiss franc represent major challenges for the industry, which will have to redouble its efforts to preserve its workforce and maintain its production capacity.

January 23, 2025

News

News